Over 100,000 police officers miss out on insurance benefits despite Sh6 billion cover

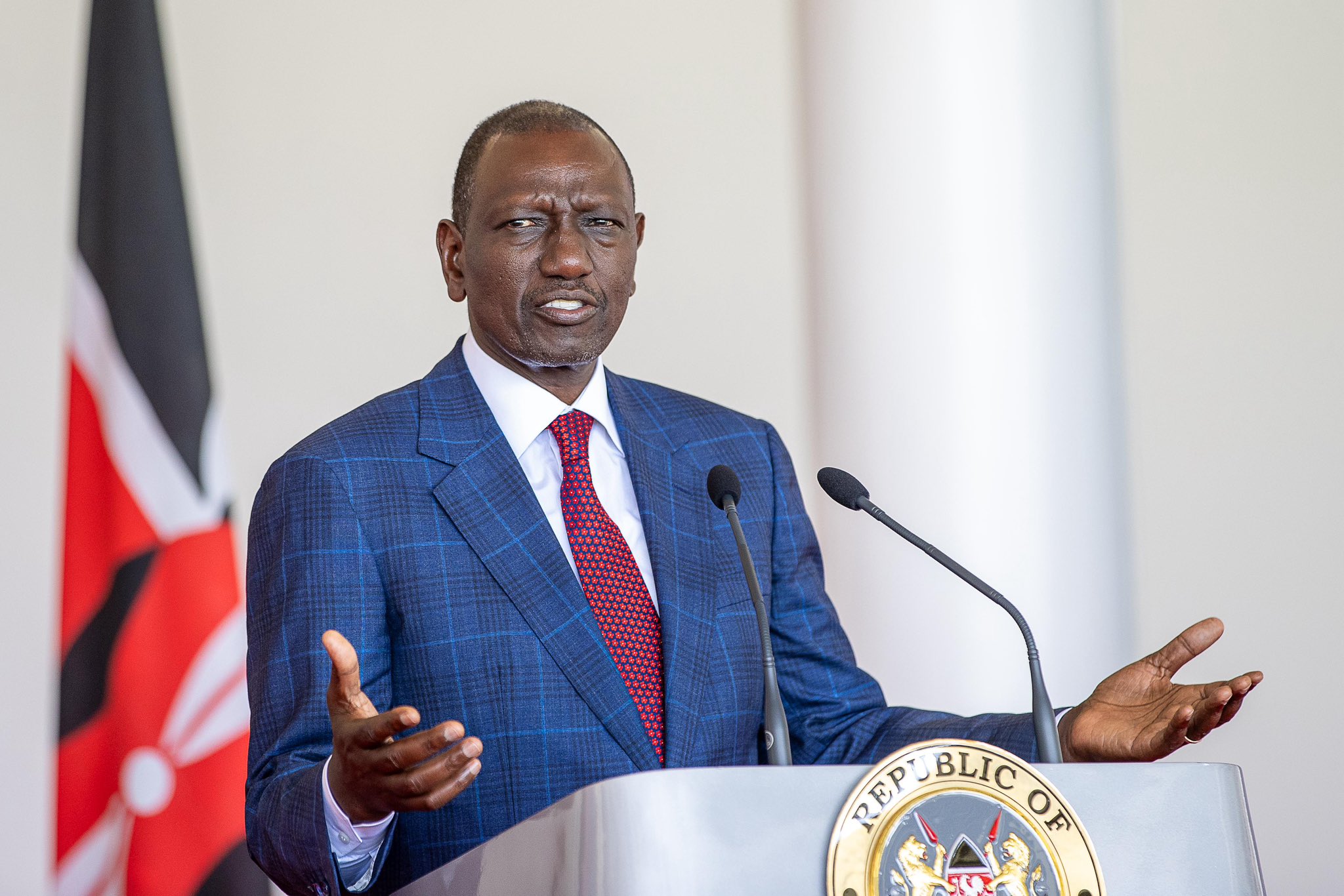

Gathungu faults NPS accounting officer Bernice Lemedeket for failing to ensure proper management of the contract awarded for the insurance provision.

Over 100,000 police officers may have been denied critical insurance benefits despite the government spending over Sh6 billion on a cover meant to protect them and their families.

According to Auditor General Nancy Gathungu, the National Police Service failed to monitor the contract effectively, resulting in unpaid claims and a lack of oversight, potentially leaving officers and their families unprotected.

More To Read

- Auditor General wants law changed to punish leaders ignoring audit recommendations

- Kenya’s police brutality victims trapped in endless cycle of political promises and no justice

- Taxpayers lose Sh5.7bn as govt agencies mismanage donor funds – Auditor General

- Six arrested over killing of Catholic priest in Elgeyo Marakwet; police rule out banditry

- Report: Deep-rooted police issues fuel public distrust despite years of community policing

- MPs slash police insurance budget by Sh883 million to settle debt on stalled Mbagathi hospital

The revelations are contained in the Auditor-General’s report on the accounts of the National Police Service (NPS) for the 2023/24 financial year, which is currently before Parliament.

Gathungu faults NPS accounting officer Bernice Lemedeket for failing to ensure proper management of the contract awarded for the insurance provision.

“The management did not adequately monitor the contract to ensure that the contract terms were complied with and ensure value for money and benefit to the members and their beneficiaries,” reads the audit report.

In 2023, NPS contracted the National Health Insurance Fund (NHIF) to provide insurance coverage for uniformed officers. NHIF then partnered with a consortium of insurance companies to deliver the services.

The cover included Group Life Insurance, Work Injury Benefit Act (Wiba), and Group Personal Accident (GPA) insurance at an annual premium of Sh5.08 billion. It covered 141,961 principal members, comprising 109,557 police officers and 32,404 prison officers and their dependents.

The contract ran from January 1 to December 31, 2023, before being extended for three more months until March 2024 at an additional premium of Sh1.3 billion.

Despite the huge expenditure, Gathungu’s audit flagged several irregularities, particularly in the settlement of claims. A review of insurance records showed that 262 GPA claims remained unpaid despite the insurer having been notified.

21 group life claims valued at Sh43.5 million had also not been paid as of the time of the audit.

Clause 2.3.1 of the contract stipulates that, in the event of a member’s death, the declared next of kin should be paid a lump sum equivalent to five years of the member’s annual basic salary. The contract further requires that “claims shall be paid within five days after notification and provision of all documents.”

"At the time of the audit, the insurer had not paid 21 claims worth Sh43.5 million in respect of the group life sum assured. This was contrary to the contract terms, which state that claims shall be paid within five days after notification and provision of all documents."

The audit also found that claims related to workplace injuries had not been addressed. The report reveals that 509 Wiba claims and two Wiba-related deaths had not been compensated.

The contract provides that compensation for temporary disablement should be made through periodical payments equivalent to the member’s salary, and such payments should continue “for as long as the temporary disablement continues but not for a period that exceeds 12 months.”

"Periodical payments shall be made for as long as the temporary disablement continues but not for a period that exceeds 12 months," reads the contract.

Additionally, in cases of death or total disablement resulting from occupational accidents, Wiba requires compensation at a rate equivalent to eight years of the beneficiary’s gross salary.

Gathungu said the findings suggest a serious breach of contract and a failure in oversight, raising fears that the intended beneficiaries, officers who risk their lives daily, may have received little to no support despite the billions paid out for the cover.

Top Stories Today